Trading can be a lucrative business. For some people it is a passive way of earning some extra cash, while for others it is a rather active way of earning full-time income. Once you have your trading strategies and investment principles defined, trading profitably can be easy. But, getting started with the right framework is oftentimes what most trading beginners struggle with.

I surveyed 5000+ traders (and interviewed 50+ profitable traders) to identify key steps and choices that differentiate successful traders from unsuccessful ones. With these learnings I identified 7 statistically proven steps that you can take today to become a consistently profitable trader.

In this article, alongside walking you through these 7 steps to profitable trading, I will also share with you the very data (collected through surveying 5000+ traders) that led me to a particular conclusion or recommendation. Therefore, irrespective of where you stand in your trading journey, I am confident that you will find this article useful. Now, without further ado, let’s get started!

Table of Contents

7 Statistically Proven Steps To Profitable Trading

To come up with this ‘7 Step To Trading Success Guide’, I spent 8+ months in research and gathered data points from 5000+ traders. Therefore, I am extremely confident that by simply following these 7 steps, you will see a remarkable improvements in your trading results.

Now, based on an extremely thorough assessment of collected survey data, below are the 7 statistically proven steps that one can take to become a consistently profitable trader:

Step-1: Understand Your True Financial Health To Keep Your Trading Emotions In Check

Yes! The first step towards profitable trading is to have a thorough understanding of your overall finances.

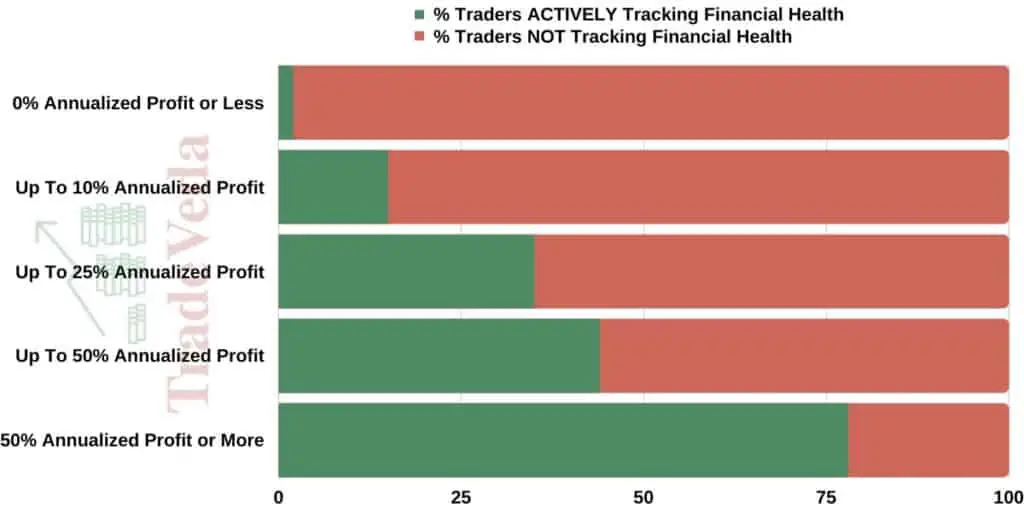

Feedback from 5000+ traders revealed a statistical correlation between profitable trading and active monitoring and management of overall finances.

To summarize key findings on the subject:

- 76% of profitable traders in my study confirmed actively monitoring their overall financial health. This overall financial health includes various investment accounts and cash positions (in different banks and trading accounts). Alternative investments, such as real estate, cryptocurrencies, etc., are also part of ones overall financial health.

- Conversely, 83% of unsuccessful traders in my study indicated a lack of discipline or intent towards active monitoring of their overall financial health.

Now, that observation is great, but it can very well be a coincidence. However, what I learnt analyzing these data points was mind boggling.

Here it goes: When I segmented profitable traders in different brackets of average annual returns, I could see an obvious correlation between an investor’s average annual returns and his/her discipline to actively monitor overall financial health. This means:

- Data collected from surveying 5000+ traders suggests, the more disciplined an investor/trader is with monitoring his/her overall financial health, the higher is his/her likelihood of making a higher profit.

Now, this was news to me! And, honestly – just by myself – I struggled to make sense out of this correlation. Therefore, I discussed this finding with a subset of 50+ consistently profitable traders, and here is what our collective assessment suggests:

- By actively monitoring one’s overall financial health, a trader ALMOST ALWAYS makes better trading decisions, without conceding to their ‘in the moment’ emotions.

Let me explain this with the help of an example:

Sometime back, I made a sizable investment in a growth stock that went down 40% in just a few days. If I look at this trade in isolation, it would not be insane of me to panic and make an irrational trading decision.

However, because I was monitoring my overall financial health, this 40% drawdown did not seem like the end of the world to me. Hence, I was able to keep my emotions in check, and stick to my original trading plan. In the end, this stock recovered and gave me more than +100% return.

- In summary: what could have been a 40% loss, resulted in more than 100% profit. Keeping my emotions in check through actively monitoring my financial health was the only reason I could personally do it.

With that example from my own trading log, I hope you can see how keeping a perspective of your overall financial health can save you from many emotional traumas of trading, and overtime make you a better trader.

So, irrespective of where you are in your trading journey, start right! Develop a habit of actively monitoring your financial health, and look at your trade positions in that broader context.

How To Actively Monitor Your Financial Health?

Tracking your overall financial health including all its components can seem daunting at first, but it’s not as difficult as it may seem.

You can simply start monitoring your overall finances in an excel spreadsheet. But, there are tons of web/mobile applications (such as – Mint, YNAB, Personal Capital, etc.) that can make monitoring overall finances a breeze for you.

I personally tried most applications (both – free and paid) for financial health monitoring, and the only one I could truly recommend for traders/investors is – Personal Capital.

Three reasons why Personal Capital is the best financial health monitoring application for traders and investors (aspiring and established alike):

- It is absolutely free to use. Plus, signing up for it is extremely easy and takes less than a minute.

- It is absolutely safe. To keep your data secured, Personal Capital uses AES-256 encryption, which is the same rigorous standard utilized by the U.S. military.

- It helps monitor your overall financial health, not just expenses. This is the only application that I came across (and as I said, I tested many) that focuses on your overall financial health, which is what your focus needs to be as a trader/investor.

In summary, Personal Capital is one free overall financial health management tool that every trader/investor must sign up for. It will take you less than 5 mins to sign up to this free app, and signing up will remarkably improve your trading and investment decisions.

Quick Note: In the next step of this 7-step to trading success guide, we will need some data on your Personal Capital account. If you have enjoyed reading this article thus far and are finding this content helpful, I recommend that you take a brief pause and sign up for your free Personal Capital account now!

Click here to sign up for Personal Capital Today!

Step-2: Understand Your Trader Profile

Now that you have a fair understanding of your financial profile, the next step to becoming a consistently profitable trader is understanding your trader profile. (Yes – they are different! :))

With the goal of creating the best possible resource for you, I reviewed 20+ frameworks from top investment/brokerage companies, and found them all to use a slightly different approach for determining trader profiles.

Unfortunately, I did not like any!

Don’t get me wrong! The trader profile frameworks used by these investment/brokerage companies works great when used by their financial advisors. However, as a DIY framework, I found their approach subjective, and overly complex.

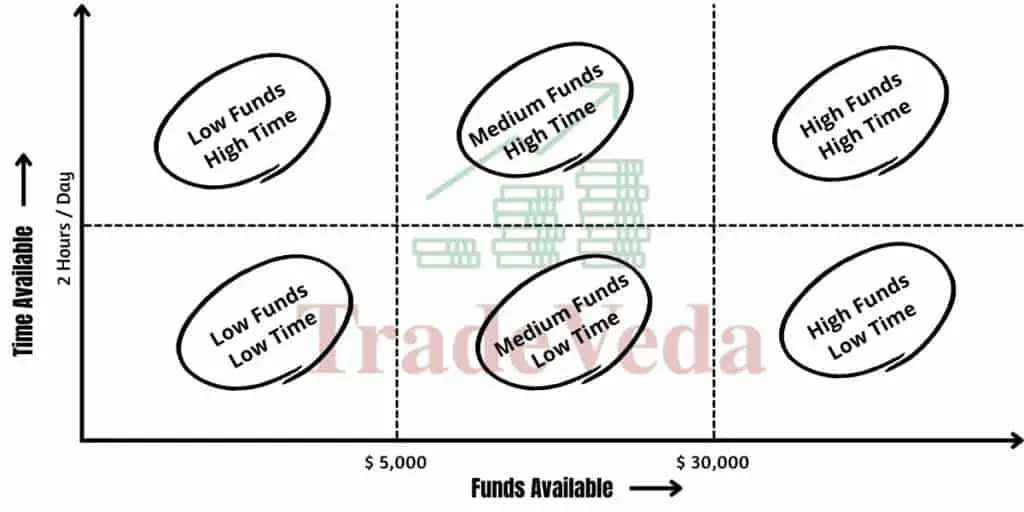

To make this step simple and effective, you should focus on just two criteria: Funds Available and Time Available.

- Funds Available: This represents the total liquid funds and investments (including cash and emergency funds) that you have at your disposal. You don’t need to be willing to invest this entire fund. This input is more to understand your overall financial health.

- If you followed my recommendation in Step-1 and signed up for a free Personal Capital account, you should have this number handy already. Alternatively, you can arrive at this number manually.

- Time Available: This represents the total time (in hours) per day that you can afford to spend on your trading/investment venture. This includes both – the time spent in researching and identifying various trade opportunities, and the actual time spent in trading.

Once you have responses to the two variables above, all you need to identify is the right fund & time profile on the chart below, and that becomes your trader profile.

Yes, it’s that simple!

In essence, depending on your funds and time availability, you could have one of these six trader profiles:

- Low Funds – Low Time: Less than $5,000 investable funds, and less than 2 hours to dedicate for trading per day.

- Low Funds – High Time: Less than $5,000 investable funds, but more than 2 hours to dedicate for trading per day.

- Medium Funds – Low Time: Less than $30,000 investable funds, and less than 2 hours to dedicate for trading per day.

- Medium Funds – High Time: Less than $30,000 investable funds, but more than 2 hours to dedicate for trading per day.

- High Funds – Low Time: More than $30,000 investable funds, but less than 2 hours to dedicate for trading per day.

- High Funds – High Time: More than $30,000 investable funds, and more than 2 hours to dedicate for trading per day.

With that, you now have your trader profile identified for the purpose of following this beginner’s guide. I know there is a lot more that goes into defining a comprehensive trader profile, but for this step-by-step guide, the granularity above would do just fine.

Reminder: If you have not acted on the first two steps yet, now would be a good time to take a brief pause and complete both these steps. To effectively follow the next step, you will need your trader profile.

Pro Trading Tip: With a free Personal Capital account, you can automate a lot of the financial assessment that you would need to regularly perform as a trader. Therefore, if you have still not signed up for your free account, Click Here To Sign Up To Personal Capital Free!

Step-3: Establish Clear, Realistic and Achievable Trading Goals

Irrespective of what your profession of choice may be, having clear goals that are both realistic and achievable is a must. Without clear goals, it’s extremely difficult to decide on a firm path for yourself, let alone staying committed to it.

When I first started trading, this was definitely the area that I struggled with the most. In all honesty – I still don’t think this part is easy!

Every experienced trader you talk to would advise you to set clear goals. But even after putting in 20+ hours of research, I could not find a good framework on goal setting that would particularly work for traders/investors.

Therefore, I was left with no option but to create one for you! 🙂

To set informed trading goals that are clear, realistic and achievable, you will first need to review the returns profile and success rate of actual traders within your trader profile. Next, comparing this data with your existing return profile, you can set trading goals that are both – objective and clear.

In theory, that framework sounds simple, but what most people struggle with is getting access to benchmark data from other traders within their trader profile. With this post, that is one problem (among several others) that I am hoping to solve for you!

Surveying 5000+ traders (and by interviewing 50+ profitable traders) I collected enough data for each trader profile. Given the thoroughness of this study, I feel comfortable sharing this data with you as a benchmark for goal setting.

Now, without further ado, let us jump straight into this benchmarking data that you can leverage in determining your trading goals.

| Trader Profile | Trader Count | Median Return (Annual) | Average Return (Annual) | Highest Return (Annual) | Lowest Return (Annual) |

|---|---|---|---|---|---|

| Low Funds – Low Time | 242 | 1% | 3% | 24% | -89% |

| Low Funds – High Time | 546 | -24% | -11% | 300% | -100% |

| Medium Funds – Low Time | 1232 | 7% | 12% | 27% | -22% |

| Medium Funds – High Time | 1343 | 4% | 10% | 55% | -34% |

| High Funds – Low Time | 1062 | 8% | 17% | 24% | -28% |

| High Funds – High Time | 756 | 6% | 13% | 47% | -32% |

Next, to leverage this data for setting your trading goals, here is the approach that I would recommend:

- If your current Annualized Return is in the proximity of the Median Return (Annual) for your trader profile, your goal for next 12 months should be to hit the Highest Return (Annual) for your trader profile.

- If your current Annualized Return is way below the Median Return (Annual) for your trader profile, your goal for next 12 months should be to reach the Median Return (Annual) for your trader profile.

- Exception-1: If with your current Annualized Return you are already beating the Highest Return for your trader profile, your goal for next 12 months should be set at 50% higher that your current annualized return. (For example – If your annualized return is 10%, your goal in this scenario would be 15%)

- Exception-2: If your trader profile is ‘Low Funds – High Time’ you will see that the Median Return (Annual) for this trader profile is -ve. If your current return is lower than this median, set your next 12 month goal at the Highest Return (Annual) for this profile.

Yes, you can all hit these goals, and in the next step we will discuss where your focus needs to be to achieve this!

However, before we move forward to the next section, there is one important observation from this benchmarking data that we have to talk about:

- Traders that dedicate less time in the market making different trade decisions, on average, are more likely to be profitable.

To clarify this statement: for every fund profile (Low Funds, Medium Funds, or High Funds), traders that have Low Time to manage their investments are on average (and on median scale) more profitable than traders with High Time in the same fund profile.

This was not something I anticipated. However, once I started interviewing traders as part of my research for this article, it all made sense.

Here is what I found: In essence, the less time a trader has the more passive are their investment choices. Data suggests that with passive investment your upside MAY BE lower than active investing, but the probability of your investments yielding positive returns is substantially higher.

That brings me to an important recommendation!

Strong Recommendation: Irrespective of what size your trading account is and how much time you can dedicate to trading, a portion of your portfolio should always be invested passively.

To come up with the best passive investing service recommendations for you, I reviewed 15+ available options and discussed my observations with 50+ profitable traders 1 on 1. Therefore, I 100% stand behind both these recommendations and am confident that you cannot go wrong signing up for both these investing services today:

- M1 Finance (Automated Investing / Robo Advisors): It offers a simple and intuitive platform to automate your investment, with really good returns when compared to its competition. If robo-investing or automated investments have ever appealed to you, Click Here to Sign Up for M1 Finance Today! (You can’t go wrong with choosing M1 Finance, and I 100% recommend you to sign up for it today)

- Acorns Automated Investing: Acorns is the other automated investing platform that impressed me quite a bit. It gives you the option to schedule regular deposits that are invested into a passive fund, such as – Bitcoin ETF. Furthermore, you can sign up for Acorns’ round up feature which will round up your day to day purchases, adding all that change to a passive investment account automatically. This is another great option to start building your passive investment portfolio. Click Here To Get $15 Bonus For Signing Up For Acorns Today! (It will take you less than 5 mins to sign up, and it is totally worth it – especially, if you want to passively invest in Bitcoin.)

Step-4: Master Trading Approach That Complements Your Trading Goals

If you have followed through this step-by-step guide for trading success, here is a quick summary of where you should be in our journey together:

- You have clarity on your overall financial health, and have a way to track it on a frequent basis. If you have not completed this step yet, Click Here to Sign Up For Your Free Personal Capital Account! It’s the best free financial tracking service for traders/investors, and it will take you less than 5 mins to sign up for it.

- You have your trader profile identified. Your trading goals, approach, and everything in-between and beyond is dependent on this trader profile. If you don’t have this one identified yet, I would strongly encourage you to complete this step before proceeding.

- You have established clear trading goals for yourself. Having clarity on what you want to achieve will determine the steps that you need to take. Therefore, if you don’t have these goals defined yet, take a quick pause and complete Step-3.

With that quick check-in out of the way, let us jump into identifying the trading approach that would suit you the most.

Analyzing data collected from surveying 5000+ traders and the insights that I gained from talking to 50+ traders one on one, it became absolutely clear to me that:

- To become a consistently profitable trader, your focus needs to be on mastering the trading approach that gives you the highest probability of success. In essence, your actions dictate your results, hence you must choose your actions depending on the results that you desire.

Also, in case you are wondering – Yes! Depending on your trader profile, the results that any particular trading approach can get you, can sizably vary.

Leveraging statistical data collected through surveying 5000+ traders, I will be help you choose the trading approach that suits your trader profile the most from the following:

- Day Trading (Short-Term Trading): Day trading or short-term trading is the approach where the holding period of your individual trades is usually under a day.

- Swing Trading (Medium-Term Trading): Swing trading or medium-term trading is the approach where the holding period of your individual trades ranges from a few days to a few weeks.

- Position Trading (Long-Term Trading): Position trading or long-term trading is the approach where the holding period of your individual trades ranges from a few months to a few years.

- Passive Trading: Passive trading is the approach where the time that you have to put into executing different trades is minimal. Everything ranging from Robo Advisors to Mutual Funds, and even automated trading, would fall within the realm of this trading method.

Now, without further ado, let us jump straight into the data that I gathered from surveying 5000+ traders, and use it to determine which trading approach would suit you the best.

The table below indicates the success rate of traders (i.e. percentage of traders profitable) from each trader profile for each of the above described trading approaches:

Trader Profile | Day Trading (Short Term Trading) – % Traders Profitable | Swing Trading (Medium Term Trading) – % Traders Profitable | Position Trading (Long Term Trading) – % Traders Profitable | Passive Trading – % Traders Profitable |

|---|---|---|---|---|

| Low Funds – Low Time | 11% | 45% | 36% | 94% |

| Low Funds – High Time | 78% | 38% | 21% | 91% |

| Medium Funds – Low Time | 15% | 48% | 53% | 92% |

| Medium Funds – High Time | 64% | 32% | 28% | 89% |

| High Funds – Low Time | 13% | 51% | 61% | 95% |

| High Funds – High Time | 54% | 29% | 61% | 91% |

To quickly summarize the key takeaways from above data:

- Irrespective of the trader profile, passive trading yielded positive results for most traders. Therefore, as also discussed in the previous section above, no matter what your current trader profile is, at least a portion of your investments must be invested through passive means.

- While there are no guarantees in trading, your likelihood of trading success will be the highest if you focus on the trading approach (besides passive investments) that yields best results for your trader profile.

Below is a quick snippet of the trading approach that traders from each trading profile should focus on (in addition to passive investing), based on a quick review of the data consolidated above:

| Trader Profile | Highest Success Probability Trading Approach (Besides Passive Trading) |

|---|---|

| Low Funds – Low Time | Swing Trading or Medium Term Trading |

| Low Funds – High Time | Day Trading or Short Term Trading |

| Medium Funds – Low Time | Position Trading or Long Term Trading |

| Medium Funds – High Time | Day Trading or Short Term Trading |

| High Funds – Low Time | Position Trading or Long Term Trading |

| High Funds – High Time | Position Trading or Long Term Trading |

Now, before we move further, listing some of my key recommendations that you can leverage for both, passive investing and active trading.

Before making these recommendations, I brainstormed these resources and discussed their pros and cons against competing services with 50+ consistently profitable traders. Therefore, each of these recommendations are extremely vetted, and you can sign up for these worry free!

Best Passive Investing Trading Options

- M1 Finance (Automated Investing / Robo Advisors): If you have ever found robo-investing or automated investments appealing, you cannot go wrong with M1 Finance. To come up with the best passive investment recommendation, I reviewed a ton of different options and M1 Finance stood second to none in my research. Click Here to Sign Up for M1 Finance Today!

- Acorns Automated Investing: By enabling passive investments into a Bitcoin ETF, Acorns gives you the best opportunity to make exponential returns on your passive investments. Plus, Acorns is currently offering a $15 bonus for simply singing up to their platform, so that is one opportunity you don’t want to miss. (assuming you are interested in this platform). Click Here To Get $15 Bonus For Signing Up For Acorns Today! (It will take you less than 5 mins to sign up, and it is totally worth it.)

Best Broker For Active Trading

- M1 Finance Brokerage Account: Upon reviewing 15+ investment services and brokerage firms, M1 Finance stood out to me and 50+ other profitable traders the most. Personally, I made the switch to M1 Finance in 2021, and have never looked back. This is one of the best brokerage platforms out there and would be my top recommendation for any and all trading approaches. Click Here to Sign Up For M1 Finance Today!

Step-5: Learn Essential Trading Skills To Become a Consistently Profitable Trader

Following this step by step guide to trading success, you should now have well defined trading goals and a pathway to achieving them. Irrespective of what those goals and pathway may be, you need to start with learning the right foundational skills.

This is perhaps the most important step in your trading journey that will eventually decide your long term success as a trader.

Depending on the trading approach that you pick, there definitely are several areas that you would need to focus on more and build an expertise in. However, to be successful in the long run, there is no escaping the basics. Irrespective of what your ultimate trading strategy turns out to be, you must at least know all the basics.

- For example, even if you plan to day trade using technical analysis, learning fundamental fundamental analysis is still important. While technical analysis can help you determine the right entries and exits for your trades, it will be fundamental analysis that will effectively guide you on what stocks to trade.

In researching the best resources that you can use for building foundational trading skills, I realized that while this happens to be the most critical step for lasting success as a trader, unfortunately it is also the most difficult one. I reviewed 30+ popular trading courses (both, free and paid) and found majority to have one of three problems:

- High quality paid trading courses that I came across are extremely expensive ($1500+). If spending that sort of money is not an issue for you, you should absolutely go for it – but that would not be my recommendation. (To clarify: Not all expensive courses were good, but I definitely found a few gems in my research.)

- Lower costing trading courses (costing around $500) that I came across were subpar. To be fair, many of these courses were fine with providing the structure to one’s learning objectives, but the content they offered was not the best one out there.

- Free trading courses that I came across were unstructured at best, and misleading/inaccurate at worst. Hence, none of these courses that I reviewed made it to my recommendation too. (Well, at least technically speaking.)

Now, before you jump the hoop and conclude that there are no good courses on trading foundations out there, let me just say this – there definitely are a few good ones out there.

However, before I give you my recommendation on trading courses that will actually deliver you real value, let me clarify the criteria that my recommendation is based on:

- Topic Coverage: Does the course cover all topics that you need to have a solid foundation on to be profitable as a trader?

- Content and Instruction Quality: Is the quality of course content top-notch and comparable to the $1500+ courses out there? Also, is the instruction delivery for that content good?

- Cost: Is the course free or reasonably priced? In no scenario, taking this course should break the bank – even for traders with extremely small accounts.

Now, with that trading course recommendation criteria out of the way, let us jump into the gems that I found for you!

Top Recommendation: Trading Strategies in Emerging Markets Specialization on Coursera

After reviewing 30+ popular trading courses (both free and paid) and brainstorming my findings with 50+ successful traders, my top recommendation on trading courses for you is the Trading Strategies in Emerging Markets Specialization on Coursera.

Irrespective of where you are in your trading journey; no matter how experienced or novice you may be → This course is a must do for you!

I did this course after 10+ years of active trading, but still found it extremely useful. Also, even though the title of the course says ‘Emerging Markets’, this course is applicable to all markets.

Hence, with no hesitation, this course gets my top recommendation and I genuinely believe that most traders, irrespective of experience level and the market that they plan to trade in, will greatly benefit from taking this course.

Listed below are the top reasons that made this course stand out to me (when compared to 30+ courses that I reviewed):

- Topic Coverage: This course focuses on building a solid foundation of trading and investment concepts that every trader needs. The title of the course indicates that it is focused around emerging markets, but having personally gone through the material, I can confidently state that its curriculum applies to all markets.

- Instruction Quality: When a course is offered by one of the globally renowned and top ranking business schools (Indian School of Business), there is no scope for a miss on the instruction quality front. This course is very well structured and is engaging with high quality instructions.

- Cost: Being offered on Coursera, you can complete this course absolutely free – provided you complete all its content within 7 days. If it takes you more than 7 days, you only need to pay less than $50 per month of Coursera instruction fees – which is negligible when compared to the value this course offers. Other courses with similar instruction quality will easily cost you $1,500+. (Having taken this course, I believe 95%+ people can complete this course within 1 month)

To conclude: For the superb instruction quality and course content that Trading Strategies in Emerging Markets Specialization offers at a negligible cost, it is the best trading course that any aspiring or experienced trader can enroll into. Other courses with content this good can easily cost you $1500+, making this course a no brainer.

Click Here to Start This Course Free Today!

(If you complete this course within 7-days, it will not cost you a penny. Plus, you can cancel your enrollment anytime within the trial period at no cost to you.)

Alternate Recommendation: Practical Guide To Trading Specialization on Coursera

In addition to the Trading Strategies in Emerging Markets Specialization, one other course that I would recommend to both aspiring and experienced traders alike is the Practical Guide To Trading Specialization on Coursera.

Where this course stands out is the topical coverage, as it covers all – Equity, Forex, Bond, and Derivative – Markets. Plus, in comparison to the Trading Strategies in Emerging Markets Specialization – my top recommendation, this course is relatively lighter (but, at no cost to its quality) and may suit casual learners a bit better.

On top of all that, being offered on Coursera platform, this course can be pursued absolutely free – assuming you can finish it within the 7-day free trial period.

Therefore, you just can’t go wrong with this course.

Click Here to Start This Course Free Today!

(If you complete this within 7-days, it will not cost you a penny. Plus, you can cancel your enrollment anytime within the trial period at no cost to you.)

Step-6: Choose The Right Tools To Profitably Invest In the Market

If you followed through this step by step guide, by this point you should have clearly defined trading goals and a pathway to achieving them. In addition, you also have some solid recommendations on high quality low cost trading/investment courses that you can pursue to for building a well rounded and successful trading strategy.

This is half the battle done!

In a car racing event, there are two things that determine the success and the failure of a driver – the driver and the car.

Trading is no different. Alongside building your core skills as a trader, you also need to choose for the right trading tools to be successful (or, at the very least – to make your path to success a smooth one).

To help you choose the right trading tools, here are my top recommendations for you. As also mentioned above, pros and cons of each recommendation listed below (in comparison to other competing services) was discussed with 50+ profitable traders before making it to this list. Hence, you can be rest assured that the chances of you going wrong with any of these recommendations is next to nothing:

- Best Financial Health Tracker For Traders/Investors: Personal Capital

- Best Passive Investment Options For Traders/Investors: M1 Finance (Robo Advisor), Acorns, CIT Bank

- Best Investment News and Trading Tips Options: The Montley Fools, Bezinga Pro

- Best Brokers For Traders/Investors: M1 Finance (For US Residents) and BlackBulls (For Non-US Residents)

- Best Charting and Social Media Platform for Traders: TradingView

- Best Trading Courses: Trading Strategies in Emerging Markets Specialization and Practical Guide To Trading Specialization

I (and 50+ other consistently profitable traders) spent a ton of time analyzing different services in each of these areas, so that you don’t have to. You can simply select the tools from the list above and enjoy trading!

Step-7: Actively Monitor Your Trading Results, and Pivot

Finally, we are down to the last step that you need to take for becoming a successful trader/investor.

It goes without saying that different things work for different people. While all the steps mentioned in this trading guide will increase your probability of trading success sizably, it is important to track your trading performance on a consistent basis and pivot when necessary (i.e. when your trading plan is not working as anticipated consistently).

To effectively track your trading performance, keeping an active track of your finances is of utmost importance. For that reason, signing up for a free finance tracker such as Personal Finance is a step you must take.

- Signing up for Personal Capital will take you less than 5-mins, and there are a ton of great insights that you can extract from this free service to effectively track your trading performance and investments. So, don’t wait and Click Here to Sign Up for Your Free Personal Capital Account Now!

In addition to tracking your overall trading/investment performance using Personal Capital, the other step that you can take is to be active on the TradingView community.

- In case you are not familiar with TradingView, think of it like a social media platform for Traders. Alongside accessing best in class technical trading charts, you can post trade ideas and review ideas from other traders on this platform. By getting your trade ideas critiqued by other experienced traders, or simply tracking the ideas that other experienced traders post, you can get a solid perspective on where things are going south and how best to course correct.

Singing Up on TradingView is absolutely free, although I would recommend getting their premium plan as it unlocks some great additional features for you.

Click Here To Sign Up For TradingView Today!

Conclusion

To conclude, we reviewed seven steps to profitable trading in this article. In addition, statistical data collected from surveying 5000+ traders that informed these seven steps was also reviewed in this article.

With following the seven steps mentioned in this article above, your probability of trading success is likely to increase considerably, there are a few steps that I would like to further emphasize on in conclusion. These are:

- Active Monitoring of Finances: Be it dealing with trading success or understanding the effectiveness of your trading strategies, active monitoring of finances is a must for all traders and investors. To make this step extremely easy at no cost, Sign Up for a Free Personal Capital Account Now! (It would not take you more than 5 mins, and it will be a really valuable step)

- Part of Your Portfolio Should Always be Passive: Irrespective of what your trader profile may be, part of your portfolio should always be in passive investments. Best option for Passive Investments from my perspective (and from the perspective of 50+ other consistently profitable traders) is Opening an M1 Finance (Automated Trading / Robo Advisor) Account. But, another good passive investment option to consider is Acorns (especially, if you are interested in getting passive exposure to Bitcoin).

- Invest in Your Trading Education: To be successful as a trader, you must spend time in educating yourself. However, don’t spend too much money in buying a super expensive course. The two coursera courses that I have recommended in this article (after reviewing 30+ popular trading courses), are good to get you all necessary trading skills at an extremely low cost (or free, if you can complete these courses within 7 days). These are:

- Monitor Your Trading Performance and Pivot: Finally, as a trader/investor, one should always monitor his/her investment outcomes on a regular basis. Regular investment monitoring will allow you to analyze the effectiveness of your trading strategy. That way, you can easily spot scenarios where your trading strategy is not working and you need to pivot. By Signing Up For a Free Personal Capital Account, you can make this process a breeze. I highly recommend that you Sign Up For a Free Personal Capital Account Today!

With that, I hope this information packed article was of help to you. I wish you luck in your trading endeavors, and would encourage you to sign up to our mailing list. We regularly publish data backed articles such as this to help you in your trading journey.

Recent Posts

Exploring Social Trading: Community, Profit, and Collaboration

Have you ever wondered about the potential of social trading? Well, that curiosity led me on a fascinating journey of surveying over 1500 traders. The aim? To understand if being part of a trading...

Ah, wine investment! A tantalizing topic that piques the curiosity of many. A complex, yet alluring world where passions and profits intertwine. But, is it a good idea? In this article, we'll uncork...