Perhaps the only thing more prevalent than technical charts in today’s stock market arena is data for traders to chart. There are so many chart types available to traders today that it’s easy to see why people ask about the specific ones professional traders use.

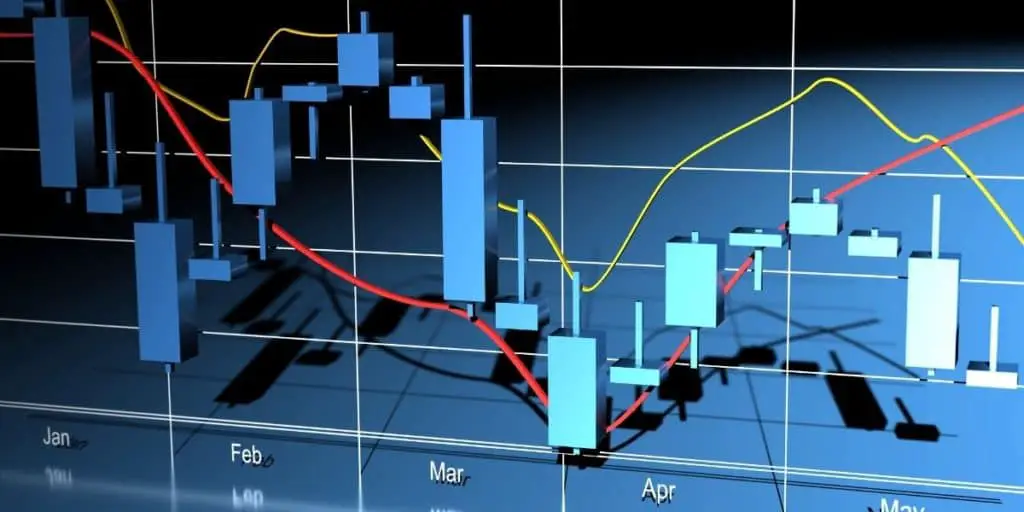

Candlestick charts are the most commonly used chart types by professional traders. However, depending on the market they are trading in and the information that they are looking for, professional traders also use other chart types such as the bar, market profile and others.

The rest of this article will explain a few topics related to this question in great detail, including why traders use charts, nine charts professional traders look at more frequently, the advantages and disadvantages of using stock charts, and various chart patterns that you should consider learning.

IMPORTANT SIDENOTE: I surveyed 1500+ traders to understand how social trading impacted their trading outcomes. The results shocked my belief system! Read my latest article: ‘Exploring Social Trading: Community, Profit, and Collaboration’ for my in-depth findings through the data collected from this survey!

Table of Contents

What Are Stock Charts?

Novice and professional traders alike use stock charts because they offer visual representations of data that can otherwise be overwhelming. Stocks are excellent tools, in part because they help take emotion out of trading.

At its most basic definition, charts, or stock charts, are graphical representations that investors use to illustrate stock prices over time. Stock charts provide crucial information, and their purpose is to give professional traders a focused view of the plethora of data available to them.

The minimum information included on any stock chart will be the stock symbol and exchange, chart period, price changes, and volume. These charts come in three basic types:

- Line charts show how a price is behaving over time.

- Bar charts illustrate the open, high, low, and close (denoted as OHLC) for each day.

- Candlestick charts provide the same information as bar charts, but they are usually more appealing to traders.

9 Most Common Chart Types That Professional Traders Use

Although data on the stock market is plentiful, without an effective design to view it, this data can become overwhelming and hinder, rather than help, traders. Because everything in the stock market is about timing, having a fast and efficient way to analyze information is key to successful trading, which is why professional traders rely on logically organized charts.

Following are nine stock chart types and what they best illustrate.

- Bar Charts – They illustrate price over time, placing greater emphasis on the closing price of stocks. Multiple price bars are charted showing the open, high, low, and close prices for a specific period of time. Each line and color have significance.

- Candlestick Charts – They illustrate relationships between open and close, but use candlesticks rather than bars to denote price changes and typically highlight trading patterns over short periods.

- EquiVolume – This indicates the point at which price and volume intersect using rectangular bars. The rectangle’s height represents lows and highs for the period, and the width represents the volume. These charts do not show open or close prices.

- Line Charts – These are the most basic of the charts available and suitable for beginners. This chart provides the stock’s closing price over time. A criticism of this chart is its failure to help traders identify trends.

- Market Profile – This type of chart exposes the most traded price/volume combination at each price level. It’s most often used to judge market equilibrium.

- Point and Figure – This chart looks at price alone without indicating time. It’s most often used with other charts, mostly to confirm the trends they suspect from other charts.

- Linear Price Scaling – These charts display absolute values of prices using dollars rather than percentages.

- Logarithmic Charts – They most often help gain perspective for long-term analysis of price changes. Unlike the Linear Pricing Scaling chart, the logarithmic chart uses percentage points to denote price changes.

- Volume at Price – These charts are histograms that show the volume of trading and specific price points. They indicate price levels over time.

Advantages and Disadvantages of Stock Charts

Charts can be problematic when traders don’t know how to use them efficiently. For this reason, many people prefer to leave their portfolios in the hands of a skilled professional who creates and reads charts daily. However, some free charting tools are available online for those who believe they can master the skill alone.

Additionally, mastering this skill is worthwhile because, for the most part, stock charts help professional traders analyze why a stock’s price is changing, therefore they can help amateur traders make better decisions too. Basically, using specific charts can indicate how a stock may move over time. The main benefit of using stock charts, then, is to discover trends.

Moreover, reversals become more apparent when data is in a chart format, and stock and resistance points appear clearly, making traders more confident in knowing when to make a market move.

The most significant disadvantage to using charts is the learning curve. A novice trader can get lost in a sea of plot points, wasting time, and potentially losing money from making bad decisions due to an inaccurate chart reading.

There are websites, such as TradingView, that offer free charts to traders, and others like StockCharts that provide free trial periods for you to try website subscriptions that offer charts, tools, and other resources.

Still, it’s often best for novice traders to learn from a professional trader who already knows how to develop and use these charts. That may involve an initial investment, but the learning curve will be shorter, and you will soon be able to use the charts without error if you give yourself time to learn.

Patterns To Learn

When charts fail novice investors, it’s typically because patterns were missed, which is understandable—they’re difficult for new investors to spot. It’s the patterns, however, that make the charts so effective.

Following are eleven patterns for you to consider:

- Ascending Triangle – When you see the ascending triangle, it means an upward breakout is likely to occur where the two triangles converge.

- Descending Triangle – This means a downward breakout is likely to occur.

- Symmetrical Triangles – This means that the stock price is consolidating, and there could be a breakout in either direction.

- Pennants – These mean a pause is likely as the price consolidates. Volume is an important consideration with this pattern.

- Flag – This pattern is a sloped rectangle, and it usually indicates a reversal after a breakout.

- Wedge – If the wedge faces downward, prices will likely break through the resistance, with the opposite occurring with an upward-facing wedge.

- Double Bottom – This pattern is probably the easiest to spot because it looks like the letter W. This pattern exposes the points at which the price has been unsuccessful at breaking through the support level. When this situation occurs, the price often sees an upward trend.

- Double Top – This pattern is also easy to see because it resembles the letter M. It’s the opposite of Double Bottom; the price has been unsuccessful at breaking through the resistance level, signaling a downward trend.

- Head and Shoulders – These patterns suggest a downward breakout.

- Rounding Bottom – These patterns indicate that volume and price are moving in tandem, which suggests an upward trend, and the trend is most often bullish.

- Cup and Handle – These patterns signal a bullish market upward trend.

Author’s Recommendations: Top Trading and Investment Resources To Consider

Before concluding this article, I wanted to share few trading and investment resources that I have vetted, with the help of 50+ consistently profitable traders, for you. I am confident that you will greatly benefit in your trading journey by considering one or more of these resources.

- Roadmap to Becoming a Consistently Profitable Trader: I surveyed 5000+ traders (and interviewed 50+ profitable traders) to create the best possible step by step trading guide for you. Read my article: ‘7 Proven Steps To Profitable Trading’ to learn about my findings from surveying 5000+ traders, and to learn how these learnings can be leveraged to your advantage.

- Best Broker For Trading Success: I reviewed 15+ brokers and discussed my findings with 50+ consistently profitable traders. Post all that assessment, the best all round broker that our collective minds picked was M1 Finance. If you are looking to open a brokerage account, choose M1 Finance. You just cannot go wrong with it! Click Here To Sign Up for M1 Finance Today!

- Best Trading Courses You Can Take For Free (or at extremely low cost): I reviewed 30+ trading courses to recommend you the best resource, and found Trading Strategies in Emerging Markets Specialization on Coursera to beat every other course on the market. Plus, if you complete this course within 7 days, it will cost you nothing and will be absolutely free! Click Here To Sign Up Today! (If you don’t find this course valuable, you can cancel anytime within the 7 days trial period and pay nothing.)

- Best Passive Investment Platform For Exponential (Potentially) Returns: By enabling passive investments into a Bitcoin ETF, Acorns gives you the best opportunity to make exponential returns on your passive investments. Plus, Acorns is currently offering a $15 bonus for simply singing up to their platform – so that is one opportunity you don’t want to miss! (assuming you are interested in this platform). Click Here To Get $15 Bonus By Signing Up For Acorns Today! (It will take you less than 5 mins to sign up, and it is totally worth it.)

Conclusion

Regardless of your skill level of using charts, if you plan to have money invested in the stock market, it’s wise to study charts and patterns, even if you’re paying a professional to do that for you. Once you learn to see the patterns and understand how they relate to entry and exit points, you may find that you’re quite capable of managing your portfolio without paying those high commissions.

BEFORE YOU GO: Don’t forget to check out my latest article – ‘Exploring Social Trading: Community, Profit, and Collaboration’. I surveyed 1500+ traders to identify the impact social trading can have on your trading performance, and shared all my findings in this article. No matter where you are in your trading journey today, I am confident that you will find this article helpful!

Affiliate Disclosure: We participate in several affiliate programs and may be compensated if you make a purchase using our referral link, at no additional cost to you. You can, however, trust the integrity of our recommendation. Affiliate programs exist even for products that we are not recommending. We only choose to recommend you the products that we actually believe in.

Recent Posts

Exploring Social Trading: Community, Profit, and Collaboration

Have you ever wondered about the potential of social trading? Well, that curiosity led me on a fascinating journey of surveying over 1500 traders. The aim? To understand if being part of a trading...

Ah, wine investment! A tantalizing topic that piques the curiosity of many. A complex, yet alluring world where passions and profits intertwine. But, is it a good idea? In this article, we'll uncork...